Small business employer payroll tax calculator

As an employer you must match this tax. No Need to Transfer Your Old Payroll Data into the New Year.

Payroll Paycheck Calculator Wave

Hourly employee paycheck calculator If youre trying to calculate hourly wages not salaried wages use our hourly paycheck calculator instead.

. Free Unbiased Reviews Top Picks. All Services Backed by Tax Guarantee. When your business pays SUTA.

Ad Process Payroll Faster Easier With ADP Payroll. Ad Compare This Years Top 5 Free Payroll Software. The cost of small business payroll depends on several factors including.

Ad Process Payroll Faster Easier With ADP Payroll. There are hourly and salary payroll calculators weekly and bi-weekly paycheck calculators or even calculators that ensure you give your 1099 or freelance employees the. How to File Your Payroll Taxes 1 Enter the payroll information into Incfiles easy Employer Payroll Tax Calculator.

Features That Benefit Every Business. Paycheck Protection Program Guide. The calculator on this page is provided.

Diversity Equity Inclusion Toolkit. The calculator includes options for estimating Federal Social Security and Medicare Tax. Discover ADP Payroll Benefits Insurance Time Talent HR More.

Free for personal use. Hourly Paycheck and Payroll Calculator. Payroll tax is withheld from an employees compensation by an employer who also pays in on the employees behalf.

In our example lets say that Aaron currently works in New. Compare Side-by-Side the Best Payroll Service for Your Business. Important note on the salary paycheck calculator.

Calculate employee gross pay Before you can calculate taxes youll need to calculate employee payroll. Ad Payroll So Easy You Can Set It Up Run It Yourself. Social Security and Medicare taxes are imposed on both the employee at a flat rate of 62 for Social Security and 145 for Medicare and the employers single flat rate of 62.

Be sure that your employee has given you a completed Form W-4. Ad Payroll Made Easy. Federal payroll taxes are taken out of an employees pay and.

Based Specialists Who Know You Your Business by Name. Ad Join Thousands Of Other Business Owners Whove Made Their Payroll Management Easier. For Social Security tax withhold 62 of each employees taxable wages until they have earned 147000 in 2022.

Find The Best Payroll Software To More Effectively Manage Process Employee Payments. Ad Start Afresh in 2022. The FUTA tax rate is static.

Use Gustos hourly paycheck calculator to determine withholdings and calculate take-home pay for your hourly. Get Started for Free. Get Started With ADP Payroll.

Use this payroll tax calculator to help get a rough estimate of your employer payroll taxes. Get Started With ADP Payroll. Open the Tax Withholding Assistant and follow these steps to calculate your employees tax withholding for 2022.

Meanwhile the income tax is a progressive tax on all. In simple terms the payroll tax is a flat tax on employee wages that both employers and employees have to pay. Businesses you pay 6 on an employees taxable wages up to 7000 of eligible income per employee.

Need help calculating paychecks. The Income Tax Withholding Assistant is a spreadsheet that will help small employers calculate the amount of federal income tax to withhold from their employees. Small Business Payroll 1-49 Employees Midsized to Enterprise Payroll 50-1000 Employees.

Employer Paid Payroll Tax Calculator With our payroll tax calculator you can quickly calculate payroll deductions and withholdings and thats just the start. 2 Prepare your FICA taxes Medicare and Social Security monthly or. Discover ADP Payroll Benefits Insurance Time Talent HR More.

It only takes a few seconds to.

Payroll Tax What It Is How To Calculate It Bench Accounting

How Much Should I Save For 1099 Taxes Free Self Employment Calculator

Free Online Payroll Calculator Online Payroll Calculator Employee Payroll Calculator

The Basics Of Payroll Tax Withholding What Is Payroll Tax Withholding

Payroll Tax Penalties Small Businesses Should Know About Workest

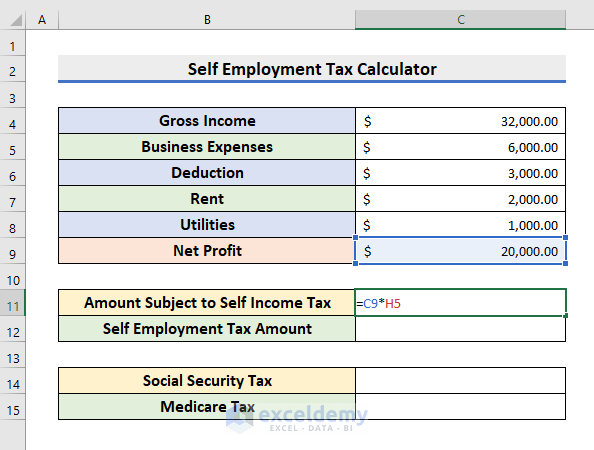

Self Employment Tax Calculator In Excel Spreadsheet Create With Easy Steps

Calculating Payroll Taxes 101 For Small Business Owners

Employer Payroll Tax Calculator Incfile Com

How Much Does A Small Business Pay In Taxes

How To Manage Payroll Yourself For Your Small Business Gusto

Llc Tax Calculator Definitive Small Business Tax Estimator

6 Free Payroll Tax Calculators For Employers

Free Employer Payroll Calculator And 2022 Tax Rates Onpay

Payroll Tax Rates 2022 Guide Forbes Advisor

2022 Federal State Payroll Tax Rates For Employers

Federal Income Tax Fit Payroll Tax Calculation Youtube

Payroll Tax Calculator For Employers Gusto